If you are or believe you may be the victim of a foreclosure prevention scam, please call us at 888-995-HOPE™ (4673) and report it.

Our team is trained specifically to handle scam cases and can report the fraudulent parties to officials. We can file a formal complaint on your behalf. You can also help us prevent someone else from being victimized.

What is a Mortgage Scam?

Mortgage scams can be complex, but many involve a request for an up-front fee.

The Federal Trade Commission (FTC) prohibits the payment of any up-front fees to negotiate mortgage-reduction payments on behalf of a homeowner.

Nevertheless, companies and individuals continue to openly violate the rules. Scammers ask for an average up-front fee of $2,500 to modify a mortgage. The homeowner pays the fee and sees no results.

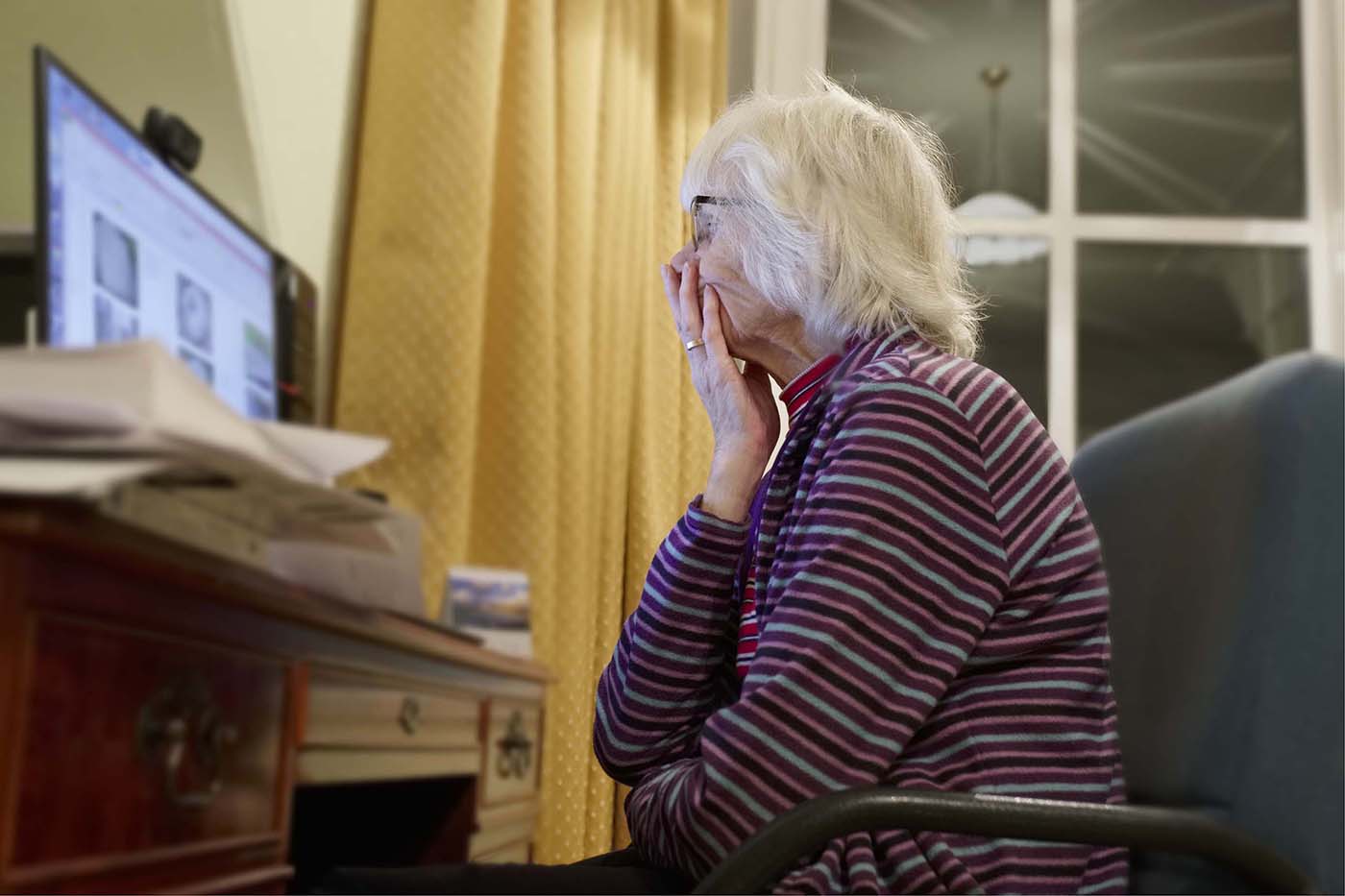

We can help those who, in addition to dealing with the stress of possible foreclosure, have been victimized by some type of fraudulent activity.

Who is at Risk?

Many scam artists seem to prey on minorities in particular. Virtually half of the potential scam calls fielded since our hotline was launched have been from homeowners who voluntarily identified themselves as African-American, Hispanic or Asian. Senior citizens across all demographics are also particularly vulnerable.

Many we speak with who are victimized by a scam artist don’t realize they had been conned.

Our team is trained to recognize scams and assist homeowners who may be victims. We educate homeowners about common scams and the red flags to look for so that they aren’t victimized in the process of trying to resolve their mortgage problems. On most cases our counselors offer preventative intervention.

What You Can Do

If you believe you are the victim of a scam, or you know someone who is, please call the HPF Homeowner’s HOPE™ Hotline at 888-995-HOPE™ (4673) today to report the scam.

We can help you – and you can help others from being victimized. You can also report a scam directly at IdentityTheft.gov.

Six Warning Signs You’ve Been Scammed

According to the U.S. Government Accountability Office, there are two primary types of foreclosure rescue and loan modification scams: Advance-fee loan modification scheme: Scammers ask you to pay a fee ahead of time for the promise of a guaranteed loan modification. Sales-leaseback scheme: There are several versions of this scam. Scammers ask the homeowner to surrender the title to his/her home in exchange for being allowed to continue occupying it as a renter, buying the home back over the next few years. Once the title is turned over, however, the scam artist forces the homeowner out of the home.

Request for advance fee

A company/person asks for a fee in advance to work with your lender to modify, refinance, or reinstate your mortgage. Know that fee requests are prohibited by the FTC. The company/person demanding fees will likely take your money without performing any of the services.

Promises and guarantees

A company/person guarantees they can stop a foreclosure or get your loan modified. This is an empty promise. No one other than your lender can guarantee they can stop foreclosure or modify your loan.

Request for transfer of payments

A company/person advises you to stop paying your mortgage company and pay them instead. Under no circumstance should you ever send a mortgage payment to anyone other than your mortgage lender.

Request for your title

A company/person pressures you to sign over the title to your home or sign any paperwork that you haven’t read or don’t fully understand. A legitimate housing advisor will never pressure you to sign a document of any kind. Remember, surrendering the title to your home is one of the two primary ways people get scammed every day!

Fraudulent loan modifications

A company/person claims to offer “government-approved” or “official government” loan modifications. Scam artists often pretend to be affiliated with the federal government. Be sure to check any third-party’s credentials by contacting your mortgage lender or by calling the HPF Homeowner’s HOPE Hotline at Call 888-995-HOPE™ (4673) to learn more about programs for which you may qualify.

Request for personal information

A company/person you don’t know asks you to release personal financial information. Always confirm that you are speaking with a legitimate company/person by contacting your mortgage lender directly or by calling the HPF Homeowner’s HOPE™ Hotline at 888-995-HOPE™ (4673).